In a recent meeting of the Reserve Bank of India’s Monetary Policy Committee (MPC), RBI Governor Shaktikanta Das announced significant developments related to the PM Vishwakarma Yojana.

The Governor revealed that PM Vishwakarma Yojana would now fall under the Payment Infrastructure Development Fund (PIDF) Scheme, which has also been granted a two-year extension.

Background on PIDF Scheme

Launched in January 2021, the PIDF Scheme’s primary aim is to establish payment acceptance facilities, such as point-of-sale (POS) systems and QR code infrastructure, in smaller

and less densely populated urban areas (Tier-3 to Tier-6 cities), the North East States, and Union Territories like Jammu and Kashmir and Ladakh.

Initially, the PIDF scheme was designed to run for three years until December 2023.

Expansion of PIDF Scheme

Governor Das announced that beneficiaries of the PM Swanidhi Scheme in Tier-1 and Tier-2 areas were included in the PIDF scheme in August 2021.

By the end of August 2023, over 2.66 crore new touchpoints had been established under the scheme.

As part of the extension, the PIDF scheme will now continue until December 31, 2025, and beneficiaries of PM Vishwakarma Yojana will be encompassed in all the program’s centers.

Boosting Digital Transactions

This expansion is expected to enhance the Reserve Bank’s efforts in promoting digital transactions at the grassroots level.

Additionally, the PIDF scheme aims to encourage the deployment of emerging payment methods, including soundbox devices and Aadhaar-based biometric devices, based on industry feedback.

These changes are anticipated to accelerate the development of payment infrastructure in targeted regions.

Governor Das mentioned that further details regarding these changes will be shared soon.

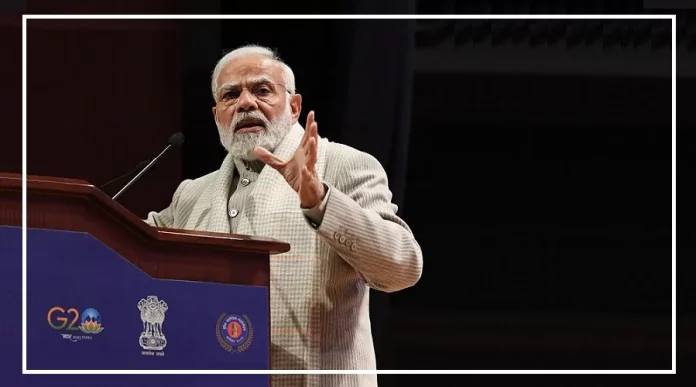

Prime Minister Narendra Modi launched PM Vishwakarma Yojana last month, intending to provide artisans with subsidies of up to 8 percent on loans.

The scheme offers loans of up to Rs 3 lakh to artisans at a highly affordable interest rate of five percent, without requiring any collateral.