The Finance Minister, Nirmala Sitharaman, made significant announcements regarding personal income tax during the presentation of the Union Budget 2023.

These announcements included a new tax regime with revised tax slabs and an increased rebate limit. Let’s delve into the details.

New Tax Regime: Effective Date and Options

The new income tax slabs came into effect on April 1, 2023, and they will be applicable to incomes earned in the financial year 2023-24, starting from April 1, 2023.

Under this regime, individuals and Hindu Undivided Families (HUFs) have the option to choose between the old tax regime and the new tax regime, which offers a lower rate of taxation.

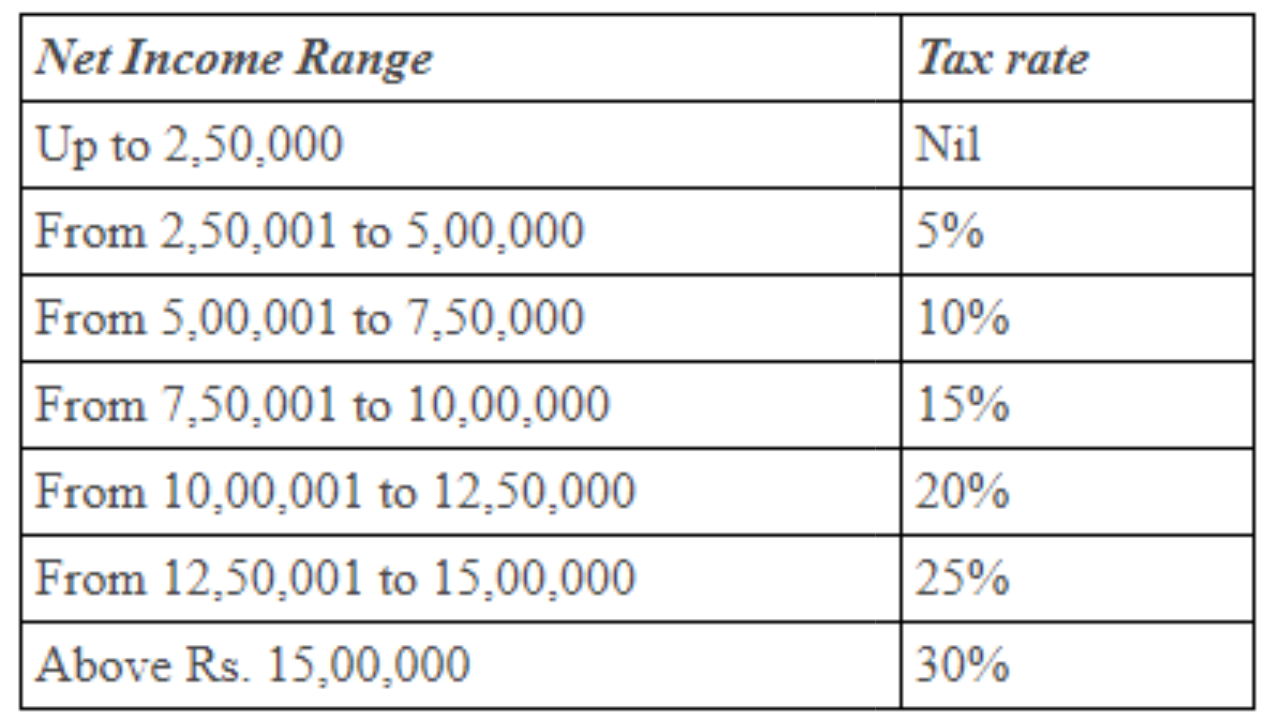

Old Tax Regime: Existing Income Tax Slabs

For those who opt for the old tax regime, the following income tax slabs apply:

- Income up to Rs 3 lakh is exempted from tax.

- Income between Rs 3 lakh and Rs 5 lakh is taxed at 5%.

- Income between Rs 5 lakh and Rs 10 lakh is taxed at 20%.

- Income above Rs 10 lakh is taxed at 30%.

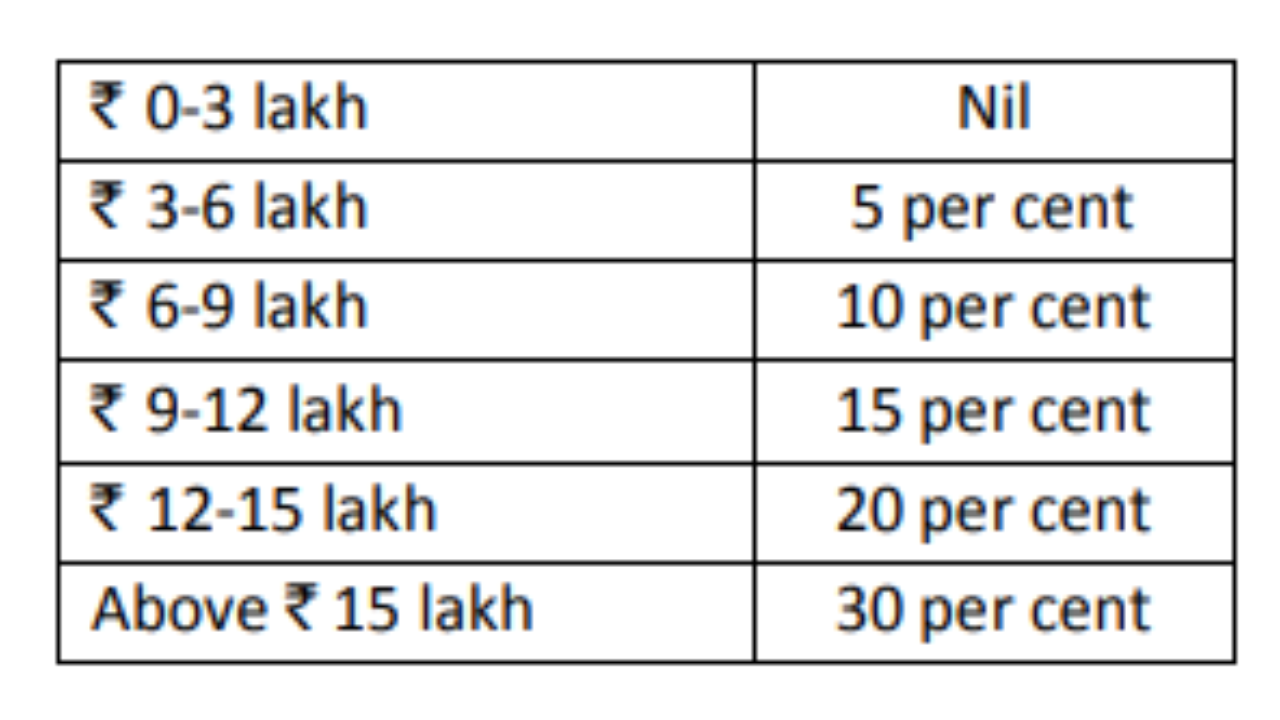

Important points to note:

Increased Tax Exemption Limit: The tax exemption limit has been raised to Rs 3 lakh from the previous Rs 2.5 lakh.

Reduction in Number of Slabs: In the new tax regime, the number of income slabs has been reduced from six to five.

Increased Rebate Limit: The rebate under Section 87A has been raised to taxable income up to Rs 7 lakh from Rs 5 lakh.

This means that individuals opting for the new tax regime with a taxable income of up to Rs 7 lakh will not have to pay any taxes.

Exemptions and Deductions: Individuals choosing the concessional rates in the new tax regime will not be eligible for certain exemptions and deductions such as 80C, 80D, 80TTB, and HRA, which are available in the old tax regime.

However, deductions under Sections 80CCD(2), 80CCH(2), and 80JJAA will still be available in the new tax regime.

These changes aim to simplify the income tax structure and provide individuals with more flexibility in choosing the tax regime that suits them best.