Income Tax Slab Rate: The general budget for the financial year 2023-24 is to be presented on February 1, 2023, and general elections will also be held in 2024.

In such a situation, the Modi government is fully engaged in preparing the last budget of its second term.

Let us tell you that in 2023, Finance Minister Nirmala Sitharaman will present the budget on February 1.

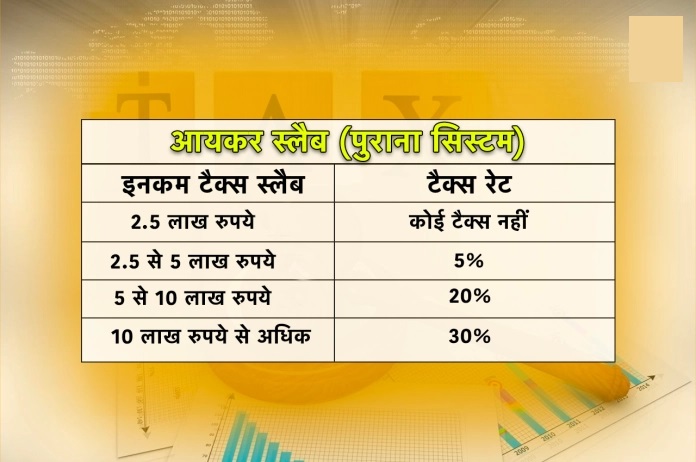

If media reports are to be believed, then there can be an important announcement for taxpayers in the budget. It is being said that the government is considering increasing the tax limit to Rs 5 lakh on annual income up to Rs 2.5 lakh.

If the central government decides in this regard, people earning up to five lakhs will not have to pay tax.

Let us tell you that the last time there was a change in the personal tax exemption limit was in 2014.

The then Finance Minister Arun Jaitley had increased the exemption limit from Rs 2 lakh to Rs 2.5 lakh in the first budget of the first term of the Modi government.

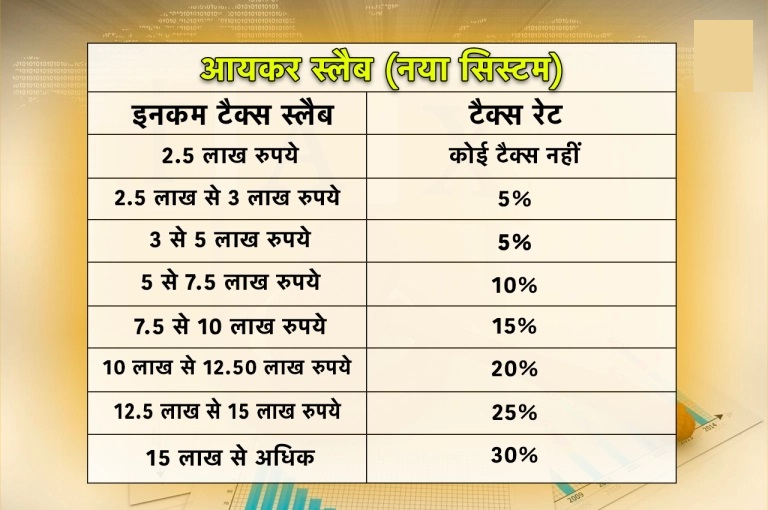

There can be a change in the tax slab

The Modi government will present the general budget in February 2023.

After one year, after about 13 months, general elections will be held in the country. The government will also keep an eye on this.

It is being said that given the general elections, the Modi government will try to increase the exemption in the tax slab.

Suggestions were also sought from many departments regarding the exemption

According to media reports, several departments have also sought suggestions regarding possible exemptions.

It will be discussed after the suggestion comes. During this, it will also be discussed whether the exemption will affect the revenue of the central government.

According to experts, people getting a salary in the new salary tax slab system will not benefit greatly.

The exemptions they are currently getting on various items can be abolished in the new tax slab.