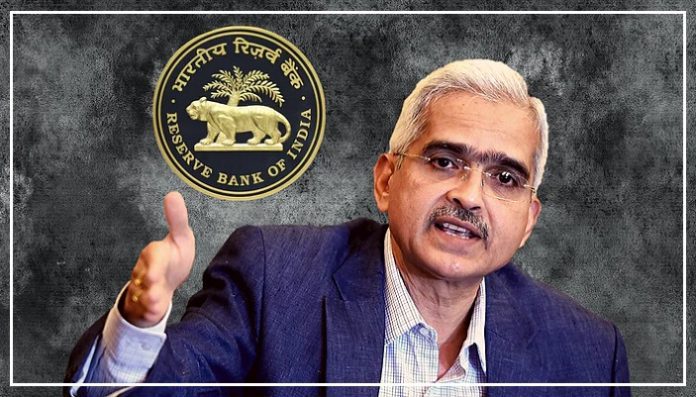

In a positive development for potential homebuyers, the Reserve Bank has announced that there will be no increase in repo rates.

This decision brings much-needed relief to those currently paying their home loan EMIs, as it means their financial burden will not increase.

The real estate industry has welcomed this move, emphasizing its positive impact on the housing sector.

Anticipated Rise in Housing Demand

Industry experts are hopeful that the central bank will consider reducing the repo rate in the upcoming monetary review.

Such a reduction would further stimulate demand for housing.

The Reserve Bank has maintained the repo rate at 6.5 percent during its recent announcement.

Boman Irani, the National President of CREDAI, expressed optimism, stating that they anticipate a sustained momentum in the demand and supply of houses.

Inflation at an 18-Month Low

Irani also highlighted that inflation is currently at an 18-month low, giving the Reserve Bank room for potential repo rate cuts in future MPC meetings.

This reduction would not only benefit the housing sector but also contribute to the growth of various industries.

Additional Announcements Required

While praising the Reserve Bank’s decision, Rajan Bandelkar, President of NAREDCO, emphasized the need for further announcements to encourage the sector.

Niranjan Hiranandani, Vice Chairman of NAREDCO, pointed out that with the festive season approaching, keeping the interest rates unchanged will boost sales.

Strong Performance in the Residential Sector

Anuj Puri, Chairman of real estate consultancy firm Anarock, stated that maintaining the repo rate will sustain the pace of home sales.

The residential sector has showcased excellent performance throughout 2023, with sales figures surpassing 1 lakh units in seven major cities during the first quarter.

Expert Advice

Pradeep Aggarwal, Chairman of Signature Global, highlighted that the Reserve Bank’s decision will support the housing market and benefit homebuyers. Atul Bansal,

Director-Finance at Omaxe Ltd, expressed hope for a policy rate reduction in the next review meeting.

Shishir Baijal, Chairman and Managing Director of Knight Frank India, believes that maintaining the repo rate will empower homebuyers to make positive decisions.

EMI to Remain Unchanged

Anurag Mathur, CEO of Savills India, confirmed that there will be no change in the monthly installment (EMI) for housing loans.

This stability will help sustain demand across various housing categories.