The Central Board of Direct Taxes (CBT) has introduced a fresh version of the Income Tax website, now accessible at www.incometaxindia.gov.in.

This new rendition of the site is designed to be mobile-friendly, ensuring a seamless experience for users.

The interface has been revamped to provide an optimal encounter, focusing on user satisfaction.

Notably, there are additional features and modules tailored for taxpayers.

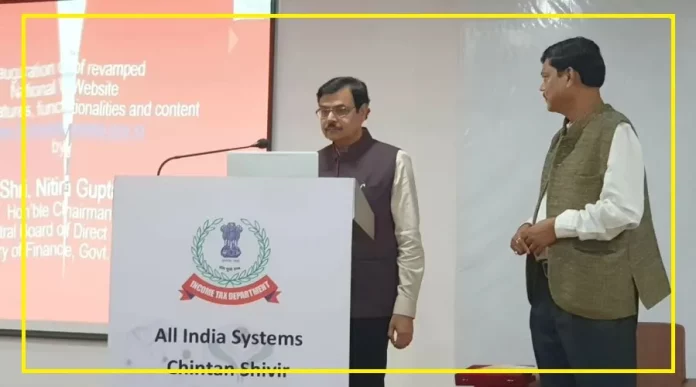

The unveiling of the new website took place at the Chintan Shivir Udaipur event, with CBDT Chairman Nitin Gupta leading the launch.

Revamped Income Tax Department Website: Your Go-To Source for Tax and Information

The redesigned Income Tax website serves as an extensive repository of tax-related information.

Alongside this, visitors will have direct access to relevant laws, including those related to direct taxes, as well as various associated acts, circulars, and notifications from the Income Tax Department.

The content will be organized within a user-friendly mega menu structure.

A notable addition is the ‘Taxpayer Services Module,’ which equips the new website with various tax tools aimed at assisting taxpayers with their income tax return filing.

Virtual Tour Feature: Navigate the New Website with Ease

For the convenience of users, a virtual guide tour is available upon visiting the website.

This feature offers a walkthrough of the new website’s functionalities, employing intuitive indicators to highlight key aspects.

Visitors can also make use of the virtual tour to compare different acts, sections, rules, and tax treaties.

All significant content on the site is conveniently tagged under the Income Tax section, simplifying navigation.

To ensure a smooth compliance process, the website incorporates a reverse countdown, tooltips, and links to pertinent portals.

Empowering Taxpayers: A Step Forward in Service

The revamped website stands as a testament to the commitment of the Income Tax Department in enhancing services for taxpayers.

This platform will continue its role in educating taxpayers and facilitating tax compliance, embodying an ongoing effort to make the process more accessible and user-friendly.