Public sector Bank of Baroda, Indian Overseas Bank, and private sector HDFC Bank have increased the loan rates.

Bank of Baroda (BoB) has increased the Marginal Cost of Funds Based Lending Rate (MCLR) by up to 0.35 percent, while HDFC Bank and IOB have increased the MCLR by up to 0.25 percent.

Due to this, the loan related to MCLR will become expensive in all three banks.

Those taking new loans based on MCLR will not only get the loan costlier than the current one, but the EMI will also increase for the existing borrowers who have taken loans based on MCLR.

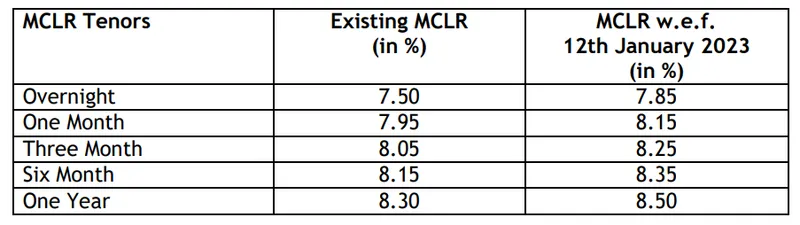

Bank of Baroda has told in the information given to the stock markets that the new rates will be effective from January 12, 2023.

Bank of Baroda’s new MCLR after the hike is like this…

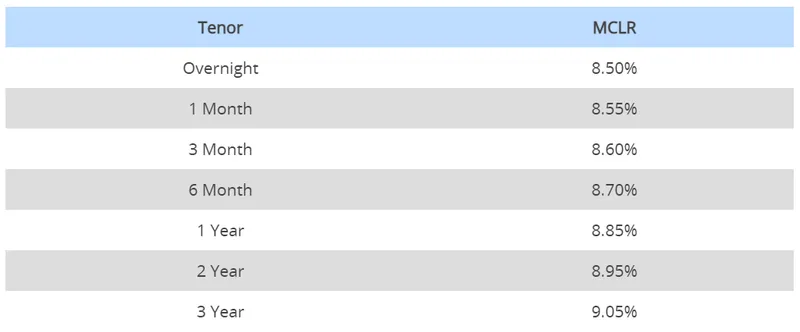

HDFC Bank’s new MCLR

HDFC Bank’s new MCLR is effective from January 7, 2023, and is as follows…

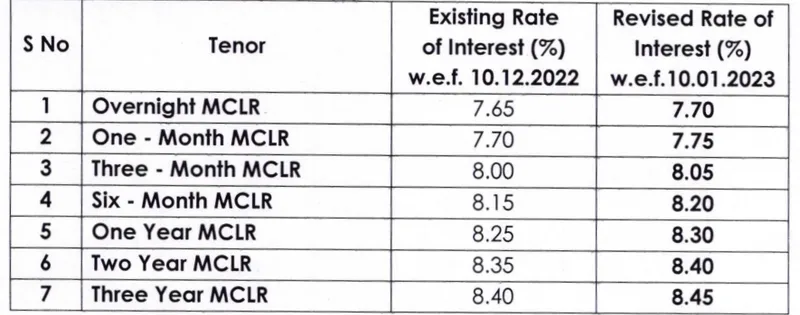

Indian Overseas Bank

Indian Overseas Bank (IOB) has told in the information given to the stock markets that the new MCLR will come into effect from January 10, 2023.

IOB has increased the MCLR rate for various tenures. The new rates are as follows…

The Reserve Bank of India (RBI) has increased the key policy rate Repo Rate by 2.25 percent since last May.

The repo rate was last increased by 0.35 percent on December 7, 2022. Currently, the repo rate is 6.25 percent.

The repo rate is the rate the central bank, RBI (Reserve Bank of India), lends to banks.

These banks have also increased the loan rate

Since the beginning of January 2023, apart from these two banks, some other banks have also increased the loan rate.

Punjab National Bank (PNB), ICICI Bank, Bank of India, and Indian Bank are also included in this list.

Punjab National Bank (Punjab National Bank) increased the base rate to 9 percent annually from January 1, 2023. Earlier it was 8.80 percent per annum.

At the same time, it increased the MCLR by up to 0.40 percent. Bank of India has increased MCLR by up to 0.15 percent,

and ICICI Bank has increased MCLR by up to 0.25 percent, and the new rates are effective from January 1, 2023.

Indian Bank has increased the MCLR by up to 0.25 percent, and the new rates are effective from January 3, 2023.