Public sector Canara Bank has increased the charges of its various debit cards. The revised orders are effective from February 13, 2023. The bank has made information about this available on its website.

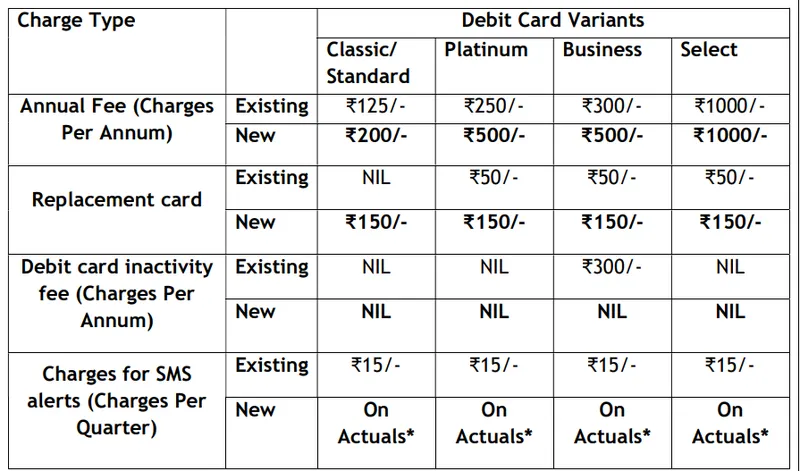

Canara Bank has increased the annual fees, card replacement charges, and debit card inactivity fees in the case of debit cards.

Apart from this, changes have also been made to the authorities for SMS alerts.

The Debit Card variants of Canara Bank include Classic/Standard, Platinum, Business, and Select card variants. The bank’s new debit card service charges are as follows…

Keep in mind that these service charges do not include taxes. Customers will have to pay applicable taxes additionally on top of these charges.

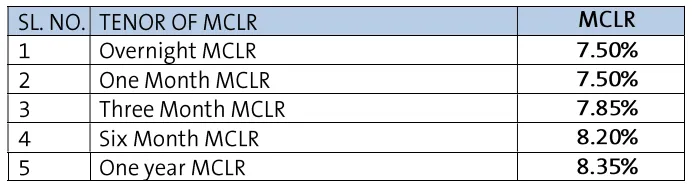

The loan rate has also increased

Canara Bank also increased the loan rate in January. This increase is up to 0.25 percent. From January 7, 2023, Canara Bank’s Repo Linked Lending Rate (RLLR) is 9.15 percent,

Short Term Repo Linked Lending Rate (STRLLR) is 6.25 percent and External Benchmark Lending Rate (EBLR) is 6.25 percent.

The new MCLR (Marginal Cost of Funds Based Lending Rates) from January 7, 2023, is like this…

SBI has increased MCLR a day before

State Bank of India (State Bank of India or SBI) increased the Marginal Cost of Fund Based Lending Rates (MCLR) on January 15, 2023.

SBI has increased MCLR by 0.10 percent. However, the bank has increased the MCLR for only one year. Most of the retail loans are based on this MCLR.

With this step of SBI, the borrowers taking new loans based on MCLR will not only get the loan costlier than

the current ones but also the EMI will increase for the existing borrowers who have taken loans based on MCLR.

This increase will not affect the EMI of borrowers based on benchmark lending rates other than MCLR.

This is the second increase in MCLR by SBI within a month. Earlier, on December 15, 2022, the bank had increased all loan rates, including MCLR, External Benchmark Based Lending Rate (EBLR),

Repo Based Lending Rate (RLLR), Benchmark Prime Lending Rate (BPLR), and Base Rate.

Currently, SBI’s EBLR is 8.90 percent + CRP + BSP. At the same time, RLLR is 8.50 percent + CRP. Apart from this, the BPLR is 14.15 percent, and the base rate is 9.40 percent.