This is the year of elections. The upcoming general elections in the country will happen in a few months.

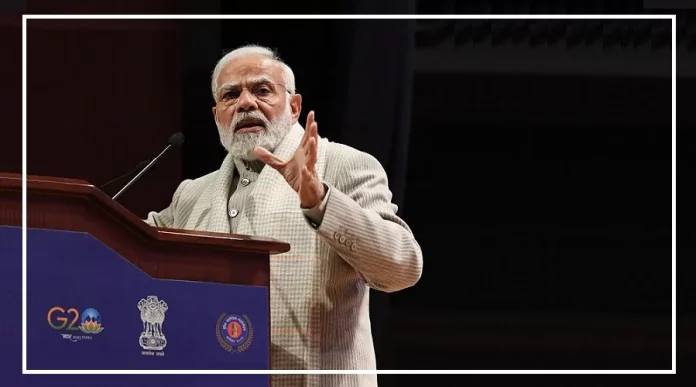

However, before that, on February 1, the government led by Prime Minister Modi will present the interim budget.

Finance Minister Nirmala Sitharaman might make a significant announcement in this budget.

According to a report from Mint, the government may increase the limit of the new tax system.

The Mint report suggests that the government might declare a tax exemption of up to Rs 7.5 lakh in the interim budget, compared to the current limit of Rs 7 lakh.

This implies that the government could provide a discount of Rs 50 to those who opt for the new tax system.

As per the report, the Finance Minister may propose changes to the Finance Bill. In the Budget for 2023, the Central Government announced a rebate of Rs 7 lakh under the new tax system.

Simultaneously, in the old tax system, the tax exemption limit was raised from Rs 2.5 lakh to Rs 3 lakh.

Additionally, the Central Government discussed an extra rebate of Rs 15,000 on family pensions.

According to a Business Standard report, 81.8 million people had filed Income Tax Returns (ITR) for the assessment year 2023-24 by December 31, 2023.

This is 9 percent more than the same period last year. It’s worth mentioning that tax revenue increased by 14.7 percent from April to November, as per the report.