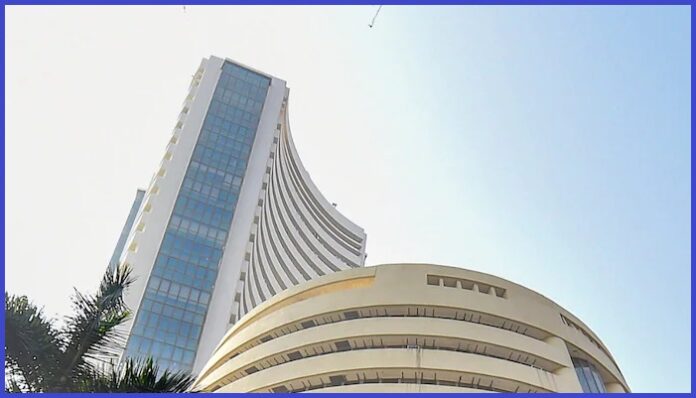

Stocks to Consider: The stock market has experienced a significant surge over the past couple of months, with the Sensex index rising by nearly 9%.

This positive trend can be attributed to various factors such as relief in inflation rates, increased investment from foreign investors, and a halt in interest rate hikes.

As a result, investor sentiment remains robust during this period.

Additionally, the strong performance of several companies in the fourth quarter has bolstered investor confidence.

We have identified three stocks that brokerage firms predict could potentially see a 35% increase from their current levels.

These stocks are Infosys, JM Financials, and State Bank of India (SBI).

Infosys

BOB Capital Markets, a brokerage firm, recommends buying Infosys shares with a target price of Rs 1760.00,

indicating a potential increase of about 35.34% from its current market price.

Another brokerage firm, ICICI Direct, expects the stock to rise by approximately 32% from its current level.

The firm rates the stock as a buy, with a target price of Rs 95.00. Currently, Infosys shares are trading at Rs 71.95.

State Bank of India (SBI)

KR Choksey (KRChoksey), a brokerage firm, projects a potential gain of around 30% for State Bank of India (SBI) shares from their current level.

The firm has given the stock a buy rating, with a target price of Rs 750.00. Currently, the shares are trading at Rs 576.55.